osceola county property tax estimator

You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000. The median property tax on a 18240000 house is 191520 in the United States.

Unfair or deceptive contact by the.

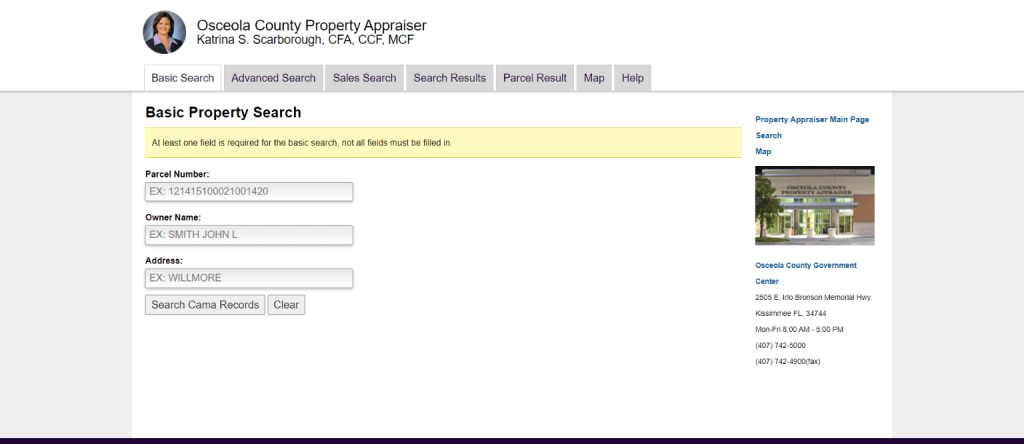

. Please fill in at least one field. Visit their website for more information. Search and Pay Property Tax.

JANUARY 15 2015 - PHISHING. Therefore the countys average effective property tax rate is 086. My team and I love connecting with the community and look forward to future parades.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. You will then be prompted to select your city village or township along. This estimator is based upon the following assumptions and mathematical variables.

Our Osceola County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Michigan and across the entire United States. Scarborough CFA CCF MCF March 8 2022 507 pm. Parcel Number Owner Name Address.

If you are thinking about becoming a resident or only planning to invest in the citys real estate youll learn whether the citys property tax laws are well suited for. Osceola County Florida Property Search. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

Renew Vehicle Registration. Remember to have your propertys Tax ID Number or Parcel Number available when you call. The median property tax on a 18240000 house is 176928 in Florida.

Monday - Friday. For a more specific estimate find the calculator for your county. Irlo Bronson Memorial Highway.

Search and Pay Business Tax. Effective March 30 2015 Class E Driving Skills Test offered at the Main Office of the Osceola County Tax Collector by appointment only. Whether you are currently a resident only pondering taking up.

Pay Tourist Tax. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided. Osceola County Property Appraiser.

Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective property tax rate of.

Osceola County Property Appraiser Katrina S. Scarborough CFA CCF MCF Osceola County Property Appraiser. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

This estimator is based on median property tax values in all of Floridas counties which can vary widely. Estimate Property Tax Our Osceola County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

Osceola County Florida Property Search. The countys average effective property tax rate comes in at 086 with a. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

This Tax Estimator is intended to assist homesteaded and non-homesteaded property owners estimate future taxes and understand the impact of amendments to the Florida State Constitution which affect real property assessments. Current Ad Valorem Taxes. 2781 BOAT COVE CIR KISSIMMEE FL 34746.

197432 14 Any holder of a tax certificate who prior to the date 2 years after April 1 of the year of issuance of the tax certificate initiates or whose agent initiates contact with the property owner upon which he or she holds a certificate encouraging or demanding payment may be barred by the tax collector from bidding a tax certificate sale. Tax Estimator Information. Search and Pay Property Tax.

Search and Pay Business Tax. 8am to 5pm Closed Saturday and Sunday. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

With the help of this recap youll receive a good understanding of real estate taxes in Osceola and what you should take into consideration when your payment is due. Parcel Number Owner Name Address. Explore how Osceola imposes its real estate taxes with this full outline.

Cloud Florida a couple of weeks ago. Pay Tourist Tax. View full property information.

We enjoyed seeing everyone at the Silver Spurs Rodeo Parade in downtown City of St. If you have documents to send you can fax them to the. The following services are offered by the Property Appraisers Office.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report. No walk-ins will be accepted for driving skills test.

Property taxes in Brevard County are somewhat lower than state and national averages. Osceola County Florida Property Tax Seminole County Indian River County The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. Search all services we offer.

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

School Board Meeting Agenda Packet Osceola County

Property Search Osceola County Property Appraiser

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

School Board Meeting Agenda Packet Osceola County

Agenda Tuesday March 15 2011 Osceola County School District

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Property Appraiser How To Check Your Property S Value